IT IS YOUR MONEY

Robinhood has rolled out 'tokenized' stocks and ETFs.

Robinhood stock surged last week after the company announced that users in Europe would be able to trade "tokenized" versions of popular US stocks and ETFs, including shares of private companies like SpaceX and OpenAI. OpenAI ultimately responded by issuing a warning that it doesn't endorse the move and wasn't involved in issuing any equity to back these tokenized shares.

The Asset Alchemist: Turning Real-World Gold, Art, and Debt Into Digital Wealth

Once, alchemists sought to turn lead into gold. Today, innovators are doing something even more powerful: turning real-world assets into digital wealth. Digital assets and real world assets (RWA) are becoming the modern alchemy—transforming physical and financial assets into liquid, tradable, and programmable digital tokens.

SEC Commissioner Proposes Cross-Border Sandbox for Crypto and Tokenized Assets

SEC’s Peirce Calls for US-UK Crypto Sandbox Alliance to Unleash Digital Asset Innovation U.S. Securities and Exchange Commission (SEC) Commissioner Hester Peirce stated on July 16 at Guildhall in London that the U.S. and U.K. should join forces to create a shared regulatory sandbox for digital assets, enabling cross-border experimentation in blockchain technology. She argued that such cooperation could bring clarity to projects

Solana catches up to competitors as tokenized assets soar 140% in 2025

Tokenized assets on Solana crossed over $418 million, rising 140.6% year-to-date and narrowing the gap with leading competitors in the space, according to a recent report from Messari. Solana's growth more than doubled the broader real-world asset (RWA) tokenization market in 2025, which expanded by 62.4% during the same period. Solana now hosts a variety of RWA tokenization projects

When Blockchain Meets Bricks: How Digital Assets and RWA Are Reinventing Construction Finance

The construction industry runs on massive capital, complex timelines, and high risk—but digital assets and real world assets (RWA) are changing the game. By tokenizing infrastructure projects, automating contractor payments, and enabling transparent funding models, blockchain is bringing efficiency, trust, and innovation to one of the oldest industries.

SEC mulls innovation exception to spur tokenization

The Securities and Exchange Commission Chair, Paul Atkins, said they are considering a regulatory exception to encourage tokenization.\r\n\r\nHe told reporters, “Staff is considering what other changes may be appropriate to incentivize tokenization within our regulatory framework, including an innovation exception.”\r\n\r\nHis remarks came shortly after the House passed the GENIUS Act—a key stablecoin bill

SEC considers Ethereum ERC-3643 token standard in tokenized securities issuance

According to an update provided by those who were present on X, the closed-door session included representatives from Chainlink Labs, the ERC-3643 Association, the Enterprise Ethereum Alliance, Etherealize, and the Law Firm Decentralized. Together with the SEC Crypto Task Force, they examined how blockchain token standard ERC-3643 could address regulatory concerns on identity, control, and compliance in the digital asset industry.

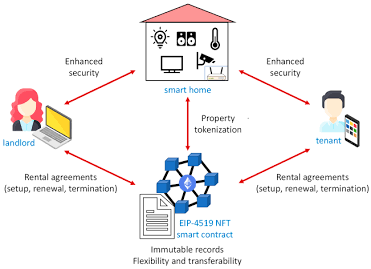

. The Rise of the Digital Landlord: How Digital Assets and RWA Are Redefining Real Estate Investment

Forget the traditional landlord with a keychain and repair calls—welcome to the era of the digital landlord , where real estate ownership is fractional, automated, and borderless. Digital assets and real world assets (RWA) are transforming real estate investment by enabling tokenized properties, self-executing leases, and global participation in one of the world’s most valuable asset classes.

Mercado Bitcoin to Tokenize Real-World Assets on XRPL Blockchain

Digital asset platform Mercado Bitcoin plans to tokenize more than $200 million in permissioned real-world assets (RWAs) on the XRP Ledger (XRPL). A key contributor to the XRPL, Ripple, announced these plans in a Friday (July 4) blog post, saying this move marks one of the largest tokenization efforts by a Latin American institution on the XRPL, which is a public blockchain designed for the tokenization of RWAs.

Why Real World Asset Tokenization Is the Future of Investing in 2025

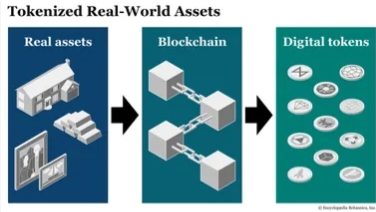

Understanding Real World Asset Tokenization Real world asset tokenization refers to the process of representing physical assets—such as real estate, gold, artwork, or even equity shares—on a blockchain as digital tokens. These tokens are backed by the actual value of the physical asset and can be traded, transferred, or owned in fractions. At its core, tokenization solves one of the oldest problems in finance: illiquidity.

From Concept to Capital: How Digital Assets and RWA Are Accelerating Startup Innovation

Startups require fast access to capital, clear investor alignment, and scalable growth strategies. Digital assets and real world assets (RWA) are accelerating startup innovation by enabling tokenized fundraising, transparent cap tables, and decentralized governance models that give founders greater control and flexibility.

Tokenization of real-world assets: Is a digital transformation underway?

Tokenization of real-world assets: It’s quite a mouthful, but what does it mean? The short answer is that it’s digital proof of ownership of an asset, represented by a token (or tokens) on a blockchain. Asset tokenization has the potential to not only replace or enhance current ownership validation methods (such as deeds, titles, or copyrights), but could also allow for easier division of ownership interest.

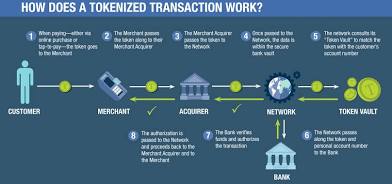

How tokenization is transforming global finance and investment

One of the major financial discussion themes at 2024’s Annual Meeting was how physical and financial assets can be ‘tokenized’, meaning that a digital representation of the asset is created on the blockchain to allow them to be exchanged securely in real time.\r\n\r\nNow after years of investment, proof of concept and testing, the planets are aligning and tokenization of financial assets is finally happening at an institutional and governmental level.

How Digital Assets and RWA Are Reshaping the Gig Economy and Freelance Work

Freelancers and gig workers represent a growing segment of the global workforce, yet they often face challenges related to payment delays, lack of benefits, and limited access to financial services. Digital assets and real world assets (RWA) are addressing these issues by enabling instant settlements, decentralized work platforms, and tokenized incentive structures that empower independent professionals.

Tokenization in financial services: Embracing a new ecosystem

Looking into a tokenized future Various financial services providers are projecting that tokenization in financial services could generate trillions of dollars in new value this decade. And while these estimates may elicit skepticism among some, they would likely represent just a tiny fraction of the global market of assets that has the potential of being tokenized. Think of the many sectors with assets that have that possibility:

SEC Roundtable on Tokenization: Technology Meets Regulation

The Tokenization Roundtable is the fourth roundtable in the series Spring Sprint Toward Crypto Clarity. The roundtables reflect the Staff’s continued interest in understanding how crypto asset technologies interact with existing securities laws and signal growing momentum toward formal rulemaking and interpretive guidance in this area. The panelists broadly agreed that tokenization has the potential to transform capital markets

The Future of Finance Is Hybrid: Blending Digital Assets and RWA for Maximum Impact

Finance is no longer binary—it's not just about crypto or fiat, digital or physical. The future belongs to hybrid finance, where digital assets and real world assets (RWA) coexist seamlessly, offering investors the best of both worlds: speed, transparency, and programmability from the digital realm combined with the stability and tangibility of real-world value.

How asset tokenization unlocks liquidity in capital market

What's driving the need for asset tokenization Traditionally, investing in assets like real estate and art required significant capital, making them inaccessible to many. Asset tokenization can shift this balance, potentially opening these asset classes to more investors. At its core, asset tokenization creates a digital representation of the ownership of a real asset stored on a blockchain: This digital asset is known as a token.

Tokenization – From illiquid to liquid real estate ownership

Tokenization – A complex, but future-oriented technology By means of tokenization based on the blockchain technology, real estate can be fragmented and then represented by digital tokens. The individual "tokens" represent the underlying property on asset level with all its rights and obligations. Contractual details are defined in so-called "smart contracts".

The Tokenization Tsunami: Why Every Business Needs a Digital Assets and RWA Strategy

A wave of tokenization is sweeping across industries—and businesses that fail to adapt risk being left behind. Digital assets and real world assets (RWA) are no longer futuristic experiments; they’re becoming essential components of modern finance, operations, and customer engagement strategies.

© 2026