IT IS YOUR MONEY

DINGO CAPITAL: Special Banking License to service Tokenized RWA-FIAT-Crypto Accounts-Wallets

Regulatory Milestone: A Banking License Ahead of Schedule Dingo.Capital’s recent acquisition of a special banking license marks a pivotal moment in its strategic evolution—arriving notably ahead of its projected Step 4 timeline in the company’s publicly shared “8 Steps to Success” framework. This regulatory approval not only validates Dingo.Capital’s compliance infrastructure but also unlocks the capacity to operate as a fully licensed financial institution with global reach.

Bank of Uganda Governor Lists 6 Foundational Pillars for Crypto Regulation in the Country.

The Bank of Uganda Governor, Dr. Michael Atingi-Ego, has highlighted the core foundations that the regulator is using to draft crypto legislation for the country. In a keynote speech at the Kampala Blockchain Summit 2025 organized by the Blockchain Association of Uganda, the Governor highlighted the importance of balancing between innovation and stability to avoid underground crypto activity while protecting markets.

Digital Natives and Digital Assets: How Gen Z Drives the Crypto Craze

The newest adults, affectionately known as Gen Z, are characterized as digital natives, having grown up immersed in a world with smartphones and tablets. Because they never knew life without a cellphone or the need for multiple devices to listen to music or take a picture, it’s unsurprising that Gen Z tends to be especially comfortable experimenting with digital currencies as well. These digital natives have approached personal finance from a wholly different angle than previous generations

"DNI" Digital Network International: The Future in Blockchain-RWA Tokenization-Digital Money & Trust

Specializing in innovative blockchain-based SaaS solutions, Digital Network International AB offers advanced services in cyber security, customer verification (KYC), consumer loyalty programs, member management, and digital voucher solutions. Our experienced team from 5 continents and our cutting-edge technologies help businesses streamlining operations, and thus focusing on their customer relationships. At the same time, they enhance data security and online privacy for their customers.

Advancing Reserve Transparency in Tokenized Gold

Tokenization of Real-World Assets (RWAs) is one of the fastest-growing segments in on-chain finance, with the potential to bring more than $400 trillion in traditional assets onto blockchain infrastructure. As the industry matures, trust and transparency in the underlying asset become critical to sustainable adoption. Commodities, particularly gold, given its long-standing role as a store of wealth

Hester Peirce Claims US SEC Ready to Promote DePIN and RWA Tokenization Projects

US SEC Commissioner Hester Peirce recently stated that the commission is open to supporting decentralized physical infrastructure network (DePIN) projects and real-world asset (RWA) tokenization. These projects aim to bring innovation and practical solutions to industries using blockchain technology. Peirce’s comments come as the SEC looks to address challenges and clarify its stance on these new developments.

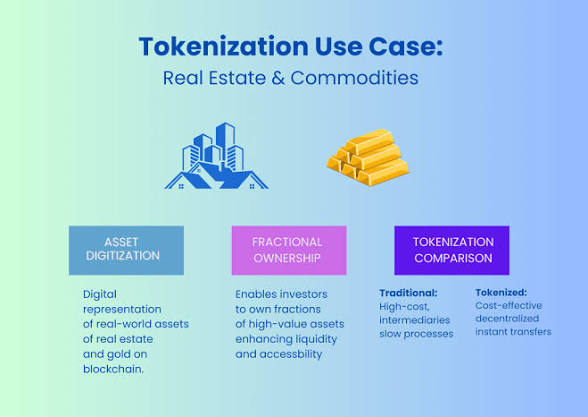

Fractional Ownership Made Easy: How Tokenization Empowers Investors

Tokenization enables fractional ownership of high-value real-world assets, dismantling financial barriers once reserved for elites. Whether it’s luxury real estate, vintage cars, or fine art, digital tokens make it possible to own a piece of almost anything. This shift empowers everyday investors with unprecedented access, liquidity, and control over diversified portfolios.

Cronos Taps Amazon Web Services to Bring RWA On-Chain

Under the partnership, Cronos’ blockchain data will feed into AWS’s cloud tools, giving developers access to ready-made reporting systems and AI-powered analytics. In simple terms, that means banks and asset managers experimenting with tokenization could get compliance-friendly data pipelines instead of building everything from scratch. AWS is also extending up to $100,000 in cloud credits to startups building on Cronos.

The Copper Powder Token: RWA Tokenization is Revolutionizing Africa’s Industrial Future

In the heart of Zambia, a quiet revolution is underway—one made not of slogans or politics, but of atoms and algorithms. A Copper Powder Company has granted Ndeipi exclusive rights to tokenize its assets, giving birth to the Copper Powder Token, a blockchain-based model that redefines how raw materials are owned, leased, and valued in the digital age. From Ore to Opportunity Copper is no longer just a metal—it’s the bloodstream of the digital economy.

Digital Assets Go Mainstream: RWA Drives Institutional Demand

Institutional investors are increasingly allocating to digital assets, not just cryptocurrencies—but tokenized real-world assets. With enhanced transparency, auditability, and programmability, RWA-backed tokens offer familiar yields with modern efficiency. This convergence marks a pivotal moment where Wall Street meets Web3, fueling long-term adoption and stability in the digital economy.

Trump Family Bets on RWA Tokenization + USD1 Stablecoin

World Liberty Financial (WLFI) announced plans to tokenize real-world assets like oil, gas, cotton, and timber at the Token2049 Web3 event.\r\nThe company aims to enhance trading efficiency and liquidity in illiquid markets by pairing these assets with their USD1 stablecoin.\r\nRegulatory support for tokenization is growing, with SEC Commissioner Hester Peirce backing the initiative, which could accelerate adoption.\r\nWLFI is also expanding its USD1 stablecoin

RWA platform enters new phase, expanding compliant access to onchain assets

Tokenization is the bridge between traditional finance and blockchain. Yet, the progress in the space has been uneven. Many projects promise access to real-world assets (RWAs) without the infrastructure or regulatory clarity to make them credible to institutions. Partnerships are often overstated, compliance frameworks underdeveloped and transparency limited. For investors and institutions, this creates an environment where trust is fragile and adoption is slowed.

(DAF) Digital Assets Foundation: Establishing Trust in the Digital Assets Ecosystem

OUR VISION Our vision is a world where financial services and markets are accessible to all through a global blockchain-based system. By tokenizing real-world assets like precious metals, real estate, and corporate shares, we enable individuals, even those with modest means, to build wealth gradually. The Digital Assets Foundation is committed to creating an inclusive, transparent, and innovative financial ecosystem that empowers everyone to thrive.

How Real-World Asset Tokenization is Transforming the Biotech Industry in 2025

The biotech industry has long been a frontier of innovation, with breakthroughs in genomics, personalized medicine, and bioengineering shaping the future of healthcare. Yet, despite its immense potential, the sector faces persistent challenges namely, funding constraints, limited liquidity, and inefficient asset management. Enter real-world asset (RWA) tokenization, a groundbreaking approach that leverages blockchain

SEC To Allow TradFi Stocks to Trade Onchain

The SEC reportedly plans to allow TradFi stocks to trade onchain through RWA tokenization, enabling 24/7 Web3-native trading. Retail investors could bypass brokerage restrictions and directly access stocks like Tesla or Nvidia via tokenized onchain assets. A rapid rollout is rumored, with potential pilot programs or broad listings that could permanently reshape traditional markets.

RWA Tokenization: Unlocking Trillions in Dormant Value

Trillions in real-world assets remain locked due to inefficiencies in ownership transfer and access. RWA tokenization leverages blockchain to digitize these assets—unlocking liquidity, transparency, and global reach. From bonds to commodities, this transformation is redefining finance by making previously static assets dynamic, measurable, and tradeable in real time across borders.

Splyce and Chintai Launch S-Token to Bring Institutional RWAs to Solana DeFi

Splyce is pleased to announce a strategic partnership with Chintai to introduce institutional-grade tokenized securities to Solana's DeFi ecosystem through innovative strategy tokens, or "S-Tokens." This collaboration addresses a critical gap in real-world asset (RWA) tokenization by enabling retail DeFi users to access yield-bearing institutional assets without traditional KYC requirements or platform restrictions. Breaking Down RWA Barriers Through Innovation

RWA tokenization enters new phase with AI servers as latest asset class

On August 8, Aurora Optoelectronics completed the first issuance of RWAs backed by artificial intelligence server assets, valued at an eight-figure RMB sum (USD 1.1–14 million). The project was supported by Ant Digital Technologies, which used its AntChain platform to record AI server operation data on-chain. The approach ensured transparency, security, and immutability, while allowing investors to verify returns.

Tokenizing Real Estate: RWA’s Gateway to Mass Investment

The tokenization of real estate is transforming how investors access property markets. By converting physical assets into digital tokens, RWA platforms enable fractional ownership, boost liquidity, and reduce entry barriers. This innovation merges traditional real estate with blockchain efficiency, offering global investors transparent, secure, and scalable opportunities in one of the world’s largest asset classes.

400T TradFi market is a huge runway for tokenized RWAs

Tokenized real-world assets may eventually represent trillions of dollars worth of traditional finance assets in a multichain future, according to Animoca.\\r\\n\\r\\n“The estimated $400 trillion addressable TradFi market underscores the potential growth runway for RWA tokenization,” said researchers Andrew Ho and Ming Ruan in an August research paper from Web3 digital property firm Animoca Brands.

© 2026