IT IS YOUR MONEY

Tokenized stocks, bigger than Bitcoin?

Cathie Wood, CEO of ARK Invest, raised eyebrows when she predicted that Bitcoin could reach $1.5 million by 2030. At that price, Bitcoin’s fully diluted value (FDV) would be $31.5 trillion. That sounds massive—however, the S&P 500 closed with a total market capitalization of $49.76 trillion on May 16, 2025. Bitcoin is often called digital gold or digital cash, but tokenized stocks represent digital equity in companies—a very different value proposition.

Digital Assets and RWA are Transforming How We Invest in Agriculture

Agriculture is one of the oldest industries, yet it’s now at the forefront of digital innovation through the convergence of digital assets and real world assets (RWA). From farmland tokenization to agri-tech financing, blockchain-based solutions are reshaping how investors engage with agricultural assets and food supply chains.

Real-World Assets (RWAs) Have Reportedly Matured into Well-Capitalized Digital Assets Sector

This evolution, driven by tokenization and institutional adoption, signals a maturing market bridging traditional finance (TradFi) and decentralized finance (DeFi).\r\n\r\nReal World Assets refer to tangible or intangible assets—such as real estate, commodities, treasuries, or private credit—tokenized on blockchains to enable fractional ownership, enhanced liquidity, and efficient trading.\r\n\r\nThe concept, rooted in early stablecoins like Tether (USDT)

Mantra unveils $108M fund to back real-world asset tokenization, DeFi

The Mantra blockchain network has launched a $108,888,888 ecosystem fund aimed at accelerating the growth of startups focused on real-world asset (RWA) tokenization and decentralized finance (DeFi), amid rising demand for stable, asset-backed digital products.\r\n\r\nMantra, a layer-1 (L1) blockchain built for tokenized RWAs, launched the Mantra Ecosystem Fund (MEF) to accelerate the growth and adoption of projects and startups building on its network

Revolutionizing the Energy Sector's Financial Model with Digital Assets and RWA

The energy sector is undergoing a transformation as digital assets and real world assets (RWA) introduce innovative financing mechanisms for renewable projects, carbon credits, and grid-scale infrastructure. Blockchain-based solutions are enabling transparent fundraising, efficient asset tracking, and direct investor participation in clean energy initiatives.

Hong Kong plans second round of digital assets innovation

Hong Kong’s Financial Secretary Paul Chan outlined plans for a second digital asset innovation push in a blog post over the weekend. After the first policy statement in 2022 formalized its approach to cryptocurrencies, it is planning to announce its future strategy soon. It sounds like the focus could be on digital securities and tokenized trade. He said Hong Kong’s next steps would “combine the advantages of traditional financial services with technological innovation

Robinhood’s RWA Letter Could Bring Wall Street Onchain

Robinhood submitted a letter to create a federal framework for tokenized real-world assets, aiming to modernize U.S. securities markets. For years, the financial world has talked about tokenizing real-world assets (RWAs). RWA tokenization is projected to become a $30 trillion market by 2030, according to research from The Trading View. This surge is driven by rising institutional interest in onchain financial products, offering faster settlement, greater transparency, and broader asset access

Digital Assets and RWA are Building the New Era of Fractional Ownership

Fractional ownership has long been limited to niche markets due to logistical complexities and high transaction costs. However, digital assets and real world assets (RWA) are changing this landscape by enabling seamless, transparent, and scalable fractionalization of high-value assets such as real estate, aircraft, and luxury goods.

Enter RWA Space with Launch of Regulated, Bank-Issued Stablecoin in Partnership

DeFi Technologies Inc. (the "Company" or "DeFi Technologies") (Nasdaq: DEFT) (CBOE CA: DEFI) (GR: R9B), a financial technology company bridging the gap between traditional capital markets and decentralized finance ("DeFi"), is pleased to announce a strategic joint venture and foundational equity investment in Fire Labs, Inc. ("Fire Labs"), a next-generation stablecoin infrastructure provider incubated and backed by America First Technology ("AFT").

BitGo and Polymesh Partner to Drive the Future of Real-World Asset Tokenization

Share\r\n\r\n\r\n\r\n\r\n\r\n\r\nMilestone partnership accelerates BitGo’s RWA position and sets the standard for institutional-grade digital asset tokenization\r\n\r\nZUG, Switzerland--(BUSINESS WIRE)--The Polymesh Association today announced a partnership with BitGo, the leading infrastructure provider of digital asset solutions, positioning Polymesh as BitGo’s inaugural purpose-built layer 1 blockchain for their real world asset (RWA) tokenization strategy.

The Key to Unlocking Institutional Investment through Digital Assets and RWA

Institutional investors are increasingly recognizing the potential of digital assets and real world assets (RWA) to enhance portfolio performance, reduce counterparty risks, and improve operational efficiency. As blockchain-based infrastructure matures, institutions—from pension funds to hedge funds—are exploring ways to integrate tokenized assets into their investment strategies and custodial frameworks.

Strategic Partnership to Accelerate Tokenized Real-World Asset Adoption

Mercurity Fintech Holding Inc. (MFH) has formed a strategic partnership with SBI Digital Markets (SBIDM), a subsidiary of SBI Group's digital asset arm, to advance the adoption of tokenized real-world assets. Through this collaboration, MFH's subsidiary Chaince Securities will distribute SBIDM's tokenized asset offerings to institutional investors, high-net-worth individuals, and accredited investors, ensuring compliance with SEC and FINRA regulations. In return, SBIDM will provide tokenization

Ripple’s XRP Ledger is launching tokenized commercial paper to further RWA development

\r\nRipple’s XRP Ledger is launching tokenized commercial paper to further RWA development\r\nPowerBeats\r\n06/12/2025, 03:43 AM\r\n\r\nCollect\r\nOn June 10, Bloomberg reported that Guggenheim Capital\'s subsidiary Guggenheim Treasury Services has launched its digital commercial paper on the XRP ledger associated with Ripple, providing institutional investors with the opportunity to invest in short-term debt instruments through a decentralized financial network.

How Digital Assets and RWA Are Fueling the Future of Decentralized Finance

Decentralized finance (DeFi) is evolving beyond crypto-native assets as digital assets and real world assets (RWA) become integral components of its infrastructure. By integrating tangible assets like real estate, commodities, and corporate debt into DeFi protocols, users gain access to yield-generating opportunities backed by real economic value. This fusion enhances capital efficiency, diversifies risk, and brings institutional-grade assets within reach of retail investors.

RWA tokenization market surges to new all-time high

On-chain data showed that tokenized real-world assets just hit an all-time high of $22.1 billion, a 10.5% rise in just 30 days. RWA.xyz analytics platform revealed the surge was driven by private credit and U.S. Treasury debt. Last week alone saw many announcements from traditional financial institutions and blockchain-native companies advancing their RWA initiatives. Companies like BlackRock, Libre, and MultiBank revealed their new RWA initiatives, signaling growing RWA adoption

Tokenized funds are scaling fast, hitting $5.7B

The credit rating service sees growing interest from traditional asset managers, insurers, and brokerages looking to offer clients access between fiat and digital markets. “Tokenized short-term liquidity funds are a small but rapidly growing product,” notes a June 3 report shared with Cointelegraph. These funds, typically backed by US Treasurys or other low-risk assets, operate similarly to traditional money market funds but use blockchain to issue and manage fractional shares

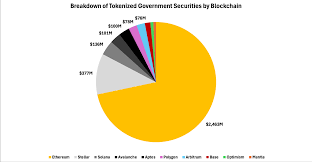

How Governments Are Embracing Tokenized Debt Instruments

Governments worldwide are exploring the potential of digital assets and real world assets (RWA) by issuing tokenized debt instruments such as bonds and treasury notes. This innovative approach aims to modernize public finance, improve investor access, and enhance the efficiency of sovereign debt markets.

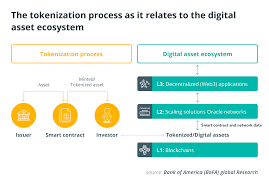

Real-World Asset Tokenization Explained

What Are Real-World Assets? Real-world assets encompass a diverse range of tangible and intangible resources that exist in the physical economy. These include commercial real estate, fine art, intellectual property, stocks, bonds, and commodities—representing untapped value worth hundreds of trillions of dollars. RWA tokenization involves converting ownership rights to these traditional assets into digital RWA tokens on blockchain networks.

Will tokenization go mainstream as founders seek alternatives to traditional funding?

Tokenization has become a valuable alternative for founders seeking to avoid the often burdensome traditional VC/PE funding route. Tokenization of real-world assets (RWA) is the process of converting ownership rights in a real-world asset — such as real estate, equity, artwork, or commodities — into a digital token that exists on a blockchain. Each token represents a share, claim, or stake in the underlying asset. Once tokenized, the asset can be traded, transferred, or used as collateral

Digital Assets and RWA: The Future of Art and Collectibles Investment

Art and collectibles have long been considered alternative investments, often reserved for the elite. But with the rise of digital assets and real world assets (RWA), these markets are becoming more accessible, transparent, and liquid. Blockchain technology is enabling the tokenization of fine art, rare coins, vintage cars, and even sports memorabilia, allowing investors to participate in unique and high-value asset classes.

© 2026