IT IS YOUR MONEY

No More Middlemen: How Digital Assets and RWA Are Cutting Out the Financial Fat

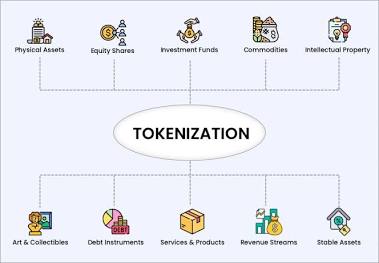

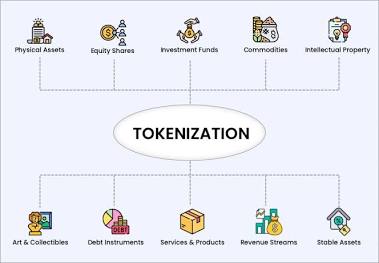

For decades, financial intermediaries—banks, brokers, custodians, and clearinghouses—have taken a cut from every transaction. Now, digital assets and real world assets (RWA) are cutting out the middlemen, enabling peer-to-peer value exchange with lower costs, faster speeds, and greater transparency.

Direct Ownership Without Custodial Layers

Investors no longer need to rely on third parties to hold their assets. With self-custodied digital wallets, individuals can securely own tokenized real estate, bonds, and commodities—reducing counterparty risk and fees.

Automated Settlements in Seconds, Not Days

Traditional financial settlements take 2–5 business days. With digital assets and RWA, transactions settle in seconds through smart contracts, eliminating the need for clearinghouses and reconciliation layers.

Real-World Use Case: JPMorgan’s Onyx and Instant Bond Settlements

JPMorgan’s blockchain network, Onyx, has demonstrated same-day settlement of tokenized bonds—proving that even legacy banks are embracing disintermediation. This reduces capital lock-up and improves liquidity for institutional investors.

Empowering Individuals with Financial Sovereignty

By removing intermediaries, digital assets and RWA give individuals greater control over their money, investments, and financial decisions—ushering in a new era of financial self-determination.

To explore how digital assets and RWA are dismantling financial gatekeepers, reach out to specialists at DigitalAssets.Foundation for expert insights and a FREE consultation.

More News

© 2026