IT IS YOUR MONEY

Digital Assets and RWA is the Key to Unlocking Underutilized Capital in Family Offices

Family offices manage vast amounts of wealth but often struggle with liquidity constraints, legacy asset lock-ups, and inefficient estate planning. Digital assets and real world assets (RWA) offer transformative solutions by enabling family offices to tokenize illiquid holdings, diversify portfolios, and implement next-generation wealth transfer strategies.

Circle Internet: Scaling Beyond USDC Toward A Tokenized Economy Powerhouse

The Circle Internet Group (CRCL) IPO is finally here. The IPO price was $31, but CRCL quickly went up over 100% on trading debut and closed day one trading at $83.23 (168% higher than IPO price). It’s been a long walk for Circle to this point, following the abandoned SPAC deal in 2022, and the long campaign that followed to position USDC (USDC-USD) as a fully transparent, compliant stablecoin within the emerging global financial infrastructure. Circle’s premier stablecoin USDC

GENIUS Act Sets Stablecoin Rules, Leaves Trump Exemption Intact

The Senate has passed the GENIUS Act, the first federal bill to establish oversight for US dollar-backed stablecoins — a type of cryptocurrency designed to maintain a stable value.\r\n\r\nThis lays the groundwork for a sweeping regulatory approach to digital payment tokens. As reported by CNBC and Yahoo Finance, the legislation gave the Treasury oversight. Treasury Secretary Scott Bessent projected the US stablecoin market could grow to $2 trillion in the next few years.

Digital Assets and RWA: Redefining Luxury Asset Ownership Through Tokenization

Luxury assets such as high-end watches, designer jewelry, vintage cars, and rare collectibles have traditionally been exclusive to elite investors due to their high value and illiquidity. Digital assets and real world assets (RWA) are now transforming this landscape through tokenization, allowing broader participation, fractional ownership, and enhanced market transparency.

Xend Finance, Risevest launch tokenized stocks platform in Africa

Xend Finance, a decentralized finance project backed by Binance and Google, is launching a platform in Africa to offer tokenized access to global real estate and stock markets. Partners in the launch include Risevest, a digital wealth management platform that offers individual and institutional investors exposure to global markets. The company recently acquired a broker-dealer license in the United States.

RWA tokenization market surges to new all-time high

Analytic platform RWA.xyz noted that on May 6, tokenized real-world assets reached an all-time high of $22.11B. On-chain data also showed that tokenized real-world assets saw a 10.5% jump in the last 30 days. The analytics firm showed that RWA total holders reached slightly over 100K, a 5.64% from 30 days ago. At the time of publication, there are also a total of 189 tokenized real-world assets issuers.

Digital Assets and RWA: The Next Frontier in Venture Capital Funding

Venture capital (VC) is evolving as digital assets and real world assets (RWA) introduce new ways to fund startups, track equity, and manage exits. By leveraging blockchain technology, VC firms and entrepreneurs can create more transparent, liquid, and inclusive funding ecosystems.

First Web3 Integrations With Blackrock And The RWA Trend

The Real-World Asset (RWA) trend has emerged as a significant sector in the financial industry, blending traditional finance with blockchain technology, peaking in 2024. Leading asset management company BlackRock has made major advancements in Real World Assets (RWA) after the BitcoinBitcoin 0.0% ETF launch earlier this year, now managing $21 billion in BTC volume. The rights to a variety of assets, including bonds, stocks, real estate, and cultural assets, will be tokenized through RWA products

Making Sense of Why FIs Are Tokenizing Real-World Assets

The tokenization of real-world assets (RWA) is emerging as more than just a token exercise. It’s another function of the blockchain landscape that has captured the imagination of various players across payments, finance and commerce: the ability for organizations to represent ownership rights of a real-world asset as a digital, on-chain token. Tokenized RWAs have the potential to make assets more liquid, accessible and efficient while enhancing transparency, security and global reach.

Digital Assets and RWA: Empowering Retail Investors Like Never Before

Retail investors have historically faced barriers to accessing high-quality assets due to high minimums, complex procedures, and limited liquidity. Digital assets and real world assets (RWA) are dismantling these obstacles, giving everyday investors unprecedented opportunities to build diversified, income-generating portfolios.

Asset Tokenisation: Blockchain’s “Killer Use-Case”

Asset tokenisation allows financial assets such as stocks, bonds and funds as well as real-world assets (RWAs) such as commodities, art, patents and real estate to be represented by digital tokens on a blockchain. These digital tokens confer ownership of and legal rights to an asset on the token holder. And because the blockchain itself is a public, immutable ledger, the technology ensures token holders that their ownership of underlying assets cannot be erased or compromised in any way.

Why Institutional Investors Are Bullish on Tokenized Assets

The results from a survey of 352 institutional investors reveal how real-world asset (RWA) tokenization is expanding. The survey reveals that 57% of investors show active interest in RWAs and 35% show a desire to know more about them. The finance sector is undergoing significant transformation because investors now understand blockchain technology because it provides better performance with secure operations and easy accessibility.

The Rise of Programmable Finance using Digital Assets and Tokenized RWA.

Programmable finance represents a paradigm shift where financial instruments and transactions are encoded into smart contracts, enabling automation, customization, and real-time execution. Digital assets and real world assets (RWA) are at the heart of this movement, unlocking new possibilities for how capital is deployed and managed.

RWA backing: How do issuers ensure 1:1 peg with tokenized assets?

The real-world asset (RWA) market has emerged as one of the key trends in the cryptocurrency industry in 2025, with companies increasingly jumping on the tokenization bandwagon. Although some studies pointed to a massive 260% increase of RWAs this year, some industry executives have questioned the magnitude of the reported market size, arguing that the sector is still too nascent and relatively small. Industry executives told Cointelegraph that slow adoption may stem from outdated regulati

Serenity and Zoniqx to launch biometric-secured tokenization for real-world assets

The initiative will synchronize digital tokens directly with Dubai’s land-registry title deeds, creating a seamless digital and legal asset ownership alignment, according to the companies. Zoniqx specializes in compliant tokenization of real-world assets (RWAs) and Serenity is blockchain data storage, security and fintech. “Our pilot project with Zoniqx in Dubai is the first step in addressing the gap between legal and digital ownership and bringing a 360-degree approach to RWA tokenization

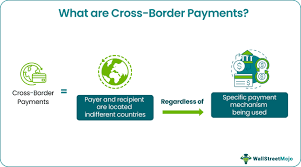

Enabling Secure Cross-Border Remittances via Digital Assets

Remittances play a vital role in global economies, particularly for migrant workers sending money home. Digital assets and real world assets (RWA) are transforming this space by offering faster, cheaper, and more transparent alternatives to traditional wire transfers and remittance services.

TokenFi Becomes First to Tokenize Real Consumer AI Robots

Turning Tiny Robots Into Real Digital Assets This tiny robot is not just a display. It has an automatic navigation system, can carry small items, and is even equipped with artificial intelligence called RICE AI. In everyday life, we can imagine this robot as a small assistant who can greet guests, deliver orders, or just accompany children to play. Now, what makes it unique is that TokenFi does not sell its robots directly, but makes them assets that can be owned through tokens.

Wall Street's Guggenheim Treasury brings its flagship tokenized debt instrument to XRP Ledger

Guggenheim Treasury Services, one of the largest and most respected asset-backed commercial paper issuers, is bringing its flagship on-chain Digital Commercial Paper (DCP) to the XRP Ledger, according to a new report from Bloomberg. Initially launched on Ethereum last September, DCP is a blockchain-powered form of commercial paper, also known as short-term, fixed-income debut instruments. Companies issue commercial paper when they need to raise quick cash for their immediate operational needs

Digital Assets and RWA are becoming the Blueprint for Modern Corporate Treasury Management

Corporate treasury functions are under pressure to adapt to rapidly changing financial environments. Digital assets and real world assets (RWA) offer a powerful toolkit for modernizing treasury operations, improving capital efficiency, and enhancing risk management across global enterprises.

Moody’s Ratings Brings Credit Rating to Solana in Real-World Asset Tokenization Trial

Global credit rating giant Moody\'s Ratings and tokenization startup Alphaledger have completed a test run showing that municipal bond credit ratings can be embedded into blockchain-based securities, the companies told CoinDesk.\r\n\r\nThe trial, conducted on the Solana SOL blockchain, showcases how credit ratings—typically distributed through proprietary data terminals—could be integrated into tokenized assets on public blockchains.

© 2026