IT IS YOUR MONEY

Real-world asset tokenization: Unlocking a new era of finance

Cointelegraph USDUSD Wylie-Schnorr Wylie-Schnorr Jan 21, 2025 Real-world asset tokenization: Unlocking a new era of finance Tokenizing real-world assets sparks a shift in finance, enabling fractional ownership, liquidity, and new regulatory frontiers. 18842 29 6:22 Real-world asset tokenization: Unlocking a new era of finance Thought Leaders Presented by Bull Blockchain Law The digital age continues to revolutionize traditional sectors, with real-world asset (RWA) tokeniza

India’s GIFT City consults on RWA tokenization

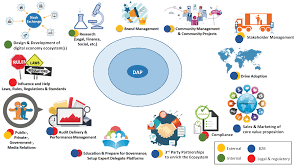

India wants to compete with international financial centers (IFCs) such as Singapore, Dubai (DIFC) and the Abu Dhabi Global Market. Hence, in 2019 it created its own International Financial Services Centre (IFSC) in GIFT City, Gujarat. Now the local regulation authority IFSCA is conducting a consultation on DLT and its use in Real World Asset (RWA) tokenization. It wants to consider the design of secondary markets for tokens from first principles.

Digital Assets and RWA: Driving Innovation in Insurance and Risk Transfer

The insurance industry is undergoing a digital transformation, with digital assets and real world assets (RWA) at the forefront of innovation. From parametric insurance to catastrophe bonds, blockchain-based solutions are enhancing risk transfer mechanisms, automating claims processing, and improving transparency across the sector.

Capital MarketsWhy the RWA revolution will not be televised

This is it, the big showdown – a Mexican standoff! The tradfi institutions, the RWA fintechs, and the crypto degens. The good, the bad, and the ugly – but not necessarily in any order. And who shoots first may depend on whether the law rolls into town. To recap, the situation for tokenizing real-world assets is stuck. Fintechs are tokenizing asset such as loans, but these lack liquidity. There’s no market-making industry. The first product to be tokenized was cash

Digital dividends: How tokenized real estate could revolutionize asset management

Disruptive technologies, such as asset tokenization, could transform real estate over the next few years. Built on blockchain technology, tokenization converts physical or financial assets into bite-sized, digital representations that can be securely traded or owned in fractional portions on a digital platform. Tokenized real estate could not only pave the way for new markets and products, but also give real estate organizations an opportunity to overcome challenges

From Gold to Crypto: The Rise of Tokenized Gold and RWA Assets

The cryptocurrency market has recently experienced significant turbulence, with total market capitalization falling below $2.7 trillion and a 7% single-day decline on April 7, driven by U.S. policy-induced volatility. In times of heightened market uncertainty, gold traditionally serves as a recognized safe haven. With the closing price of gold stood at $3,037 per ounce, gold-backed crypto assets have similarly demonstrated resilience. Assets such as XAUT (Tether Gold), representing \"crypto gold

Digital Assets and RWA: Unlocking New Opportunities in Private Equity

Private equity has long been dominated by institutional players due to high entry barriers and limited liquidity. However, digital assets and real world assets (RWA) are changing the game by enabling fractional ownership, increased transparency, and broader investor access. This evolution is transforming how private equity deals are structured, executed, and monitored.

The Quiet Revolution In Asset Markets And Tokenization

Institutional adoption brings new demands for blockchain infrastructure. Zero Hash exemplifies this shift, processing over $2 billion in tokenized fund flows across 22 blockchains in just four months. Their rails now support seven different stablecoins, powering settlements for giants like BlackRock and Franklin Templeton.\r\n\r\nRegulatory compliance drives innovation, too. Chintai secured licenses from Singapore’s MAS for compliant issuance and trading.

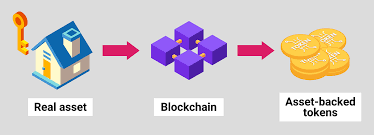

What is Real-World Asset (RWA) Tokenization?

What Are Real-World Assets? RWAs are physical or financial assets with inherent value, including commodities, bonds, real estate, mutual funds, and equities. These assets are critical to traditional finance but often suffer from limited accessibility, slow transactions, and high costs due to reliance on intermediaries. Buying or selling RWAs can involve extensive paperwork, regulatory approvals, and settlement delays that make transactions inefficient. What Is RWA Tokenization?

Digital Assets and RWA: Powering the Future of Sustainable Investing

Sustainability is becoming a central focus in global finance, and digital assets and real world assets (RWA) are playing a key role in advancing this agenda. By enabling transparent, auditable, and programmable financial instruments, blockchain-based solutions are empowering investors to support environmental, social, and governance (ESG) goals while generating competitive returns.

Tokenization of Real-World Assets: The Next Big Shift in Investment

Tokenization is turning physical assets into digital tokens on a blockchain. Tokens can represent ownership of assets such as real estate, stocks, or even art and can be traded, purchased, or sold. The greatest advantage of tokenization is fractional ownership, where investors can own a fraction of an asset instead of purchasing it whole. Tokenization breaks down most of the barriers present in conventional asset investing.

Cici Lu on Tokenized Gold: Unlocking Efficiency in a Digital Wealth Era

In a thought-provoking Hubbis webinar titled Gold 360° – Empowering Wealth Advisers to Guide HNW Clients on May 29, 2025, Cici Lu, Head of Research at Matrixdock, illuminated the transformative potential of tokenized gold for high-net-worth (HNW) investors. Joined by other industry experts from the World Gold Council, BlackRock and J. Rotbart & Co., Lu shared how blockchain-based gold tokenization is redefining wealth preservation

Digital Assets and RWA: Transforming Traditional Asset Management

Digital assets and real world assets (RWA) are redefining the landscape of asset management by introducing new efficiencies, transparency, and accessibility. As firms seek to modernize their offerings, integrating blockchain-based solutions into traditional asset classes has become a strategic priority. Whether managing portfolios, issuing securities, or facilitating trade settlements, the combination of digital and physical assets is streamlining processes and enhancing value creation.

SUPERBLOCK and the Rise of Real-World Asset Tokenization

History of Tokenization The tokenization of real-world assets has evolved dramatically. Starting in 2012–2013 with Colored Coins experiments on Bitcoin, the idea struggled due to technical limitations. Ethereum’s ERC-20 standard in 2015 provided a better framework, but adoption was slow due to regulatory uncertainty. Platforms like Harbor and Polymath (2018) tried to create compliant tokenized assets but faced infrastructure and compliance challenges.

Tokenizing entertainment: How real-world assets are reshaping the industry

What if fans could own a piece of the next big concert tour, film release, or album drop—not just as collectors, but as stakeholders? From streaming royalties to concert tickets, the entertainment industry has long thrived on exclusivity. But today, blockchain is tearing down the velvet rope. Real-world asset (RWA) tokenization, once a niche concept in finance and real estate, is rapidly gaining ground in entertainment—giving artists new tools to monetize

Digital Assets and RWA: Bridging the Gap Between Old and New Economies

The integration of digital assets and real world assets (RWA) is creating a powerful synergy between legacy economic systems and emerging blockchain technologies. By digitizing physical assets such as real estate, commodities, and intellectual property, this convergence is opening up new avenues for capital formation, asset diversification, and global investment. As both traditional and digital economies evolve, the lines between them continue to blur—ushering in a new era of financial

Asset tokenization expected to speed capital flows, says Chainlink's Nazarov

Asset tokenization is set to accelerate the movement of capital across traditional markets, according to Chainlink co-founder Sergey Nazarov. Speaking with Cointelegraph at Consensus 2025 in Toronto, Nazarov said the shift will boost capital velocity in asset classes such as treasuries, equities, private credit, commercial debt, and real estate. "I think that there are two sides to this equation. One is the asset, and the other one is the payment.

droppRWA taps RAFAL to tokenize real estate properties in Saudi Arabia

As per the announcement, the democratized access model aligns directly with Vision 2030’s objectives of financial inclusion, digital transformation, and citizen empowerment. The initiative is also designed to attract institutional-grade foreign capital through compliant digital frameworks, unlocking trillions in local and foreign direct investment (FDI) capital via a fully regulated, blockchain-based investment channel.

Why Digital Assets and RWA Are Key to the Next Investment Boom

Digital assets and real world assets (RWA) are no longer niche concepts—they’re driving the next investment boom by offering unprecedented access to traditionally illiquid markets. From real estate to private equity, these innovations are transforming how capital is raised, managed, and deployed. As blockchain technology matures, so does its ability to bridge the gap between the digital and physical worlds, unlocking trillions in previously inaccessible value.

Tokenization Is Playing a Central Role in the Shift to a Digital Economy

Though the crypto and digital assets industry has experienced its share of fads over the past few years, it has also given rise to transformative technologies like stablecoins and blockchain. These innovations are reshaping the financial landscape. Among them, tokenization has seen growing adoption by the world’s largest financial players—a trend that shows no signs of slowing down.

© 2026