IT IS YOUR MONEY

Working Through the Riddles of Tokenized Securities

For tokenized securities, the developer creates on-chain tokens that each represent a share of equity in a company or other security, or another asset that offers the right to cashflows. This tokenization can open up possibilities — such as instantaneous settlement, share fractionalization and daily dividend payments — that make the product more efficient or functionally diverse than its TradFi counterpart.

Fund Tokenization Prepares Asset Managers for ‘Perfect Storm'

Tokenization can unlock accessibility to alternative asset types and more composable assets and structures, enabling a significant change in how investors manage portfolios. With greater automation and rules-based investment allocations, entirely new strategies could also become economically viable. Integrating existing platforms with next-generation digital systems will enable the industry to modernize in stages, ultimately allowing for the adoption of new asset types at scale.

Unlocking Hidden Value: How Digital Assets and RWA Are Reviving Undervalued Industries

Many industries sit on vast amounts of undervalued or underutilized assets—from vacant commercial properties to dormant mineral rights. Digital assets and real world assets (RWA) are unlocking this hidden potential by enabling transparent valuation, fractional ownership, and efficient capital allocation.

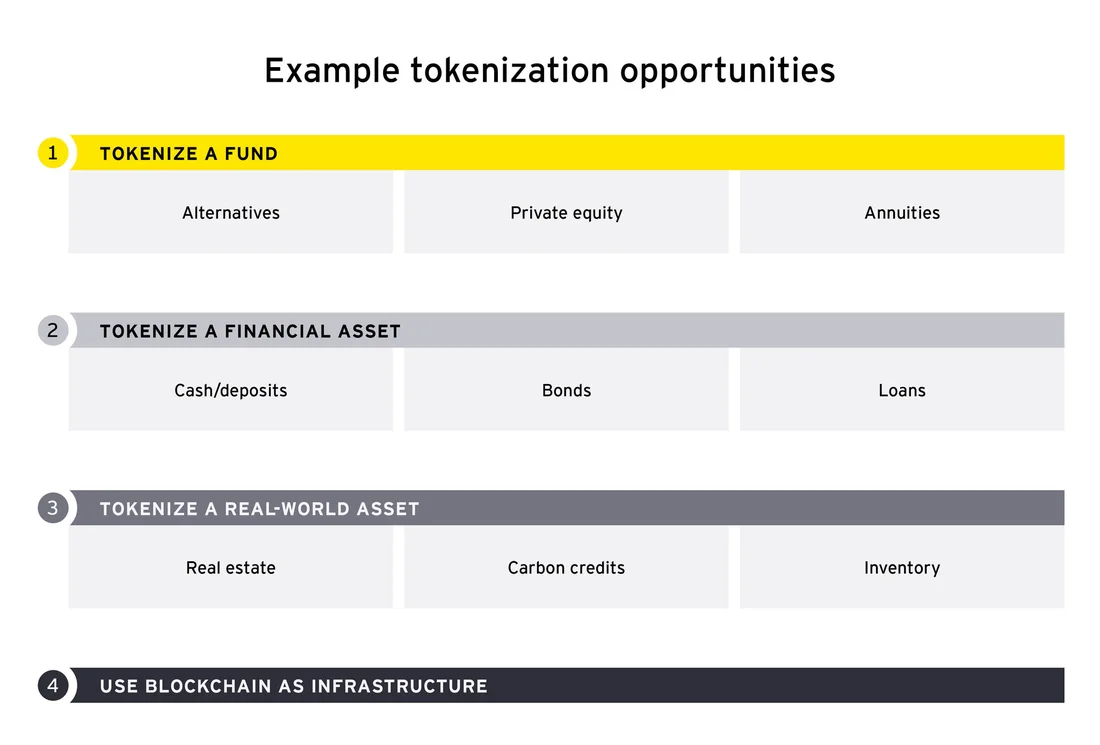

Employing digital assets and tokenization for new avenues of growth

According to an EY-Parthenon survey, 37% of institutional investors and 61% of high-net-worth investors are planning on investing in the next wave of tokenized assets in either 2023 or 2024.1 Furthermore, high-net-worth investors are intending to allocate 6.3% of their portfolios to tokenized assets in 2024. High-net-worth investors are also seeking better access to alternatives and are willing to pay higher fees for direct real estate equity.

Tokenization Has Become Wall Street’s Latest Favorite Crypto Buzzword

Tokenization, or the process of creating digital representations of real-world assets on a blockchain, has become one of this year’s buzzwords in both conventional and crypto finance circles. The excitement is reminiscent of the hype of a few years ago surrounding the use of blockchains for everything from tracking lettuce at Walmart Inc. to digitizing stocks that proved to be premature.

The role of tokenization in the financial system of the future

Tokens not only carry information about the asset they represent but also embed rules governing their operation that specify what can and cannot be done with them. This functionality, combined with their integration into programmable platforms, simplifies transaction processes that traditionally would require complex message chains and operations across multiple systems. Additionally, the use of smart contracts

The New Gold Rush: How Digital Assets and RWA Are Fueling the Token Economy

We're witnessing a new kind of gold rush—not for precious metals, but for tokenized assets. Digital assets and real world assets (RWA) are fueling the rise of the token economy, where everything from real estate and commodities to music royalties and intellectual property can be represented, traded, and monetized on blockchain networks.

Tokenization: The New Frontier for Capital Markets

Asset tokenization is the act of digitizing the ownership of an asset. At a very high level, it is not that different from the way your bank manages your checking account. Your bank doesn't have a vault stuffed with your cash in it. Instead, it has a computer with a series of 1s and 0s representing your cash balance. Banks essentially digitize our money. Digital asset tokens represent real-world assets, just as the banks' 1s and 0s represent your cash.

2025 Will Be a Brave New Tokenized World

Tokenization of real-world assets (RWAs) is revolutionizing the way we perceive and manage assets. “Tokenized RWAs,” or more simply the digital representation of physical or intangible assets using a token recorded on a blockchain, allows for the efficient recording, trading, transferring, and managing of tangible assets in a digital format. Real estate, commodities, art, and intellectual property are just some of the wide range of RWAs

From Vaults to Wallets: How Digital Assets and RWA Are Redefining Asset Storage

Asset storage has traditionally relied on banks, vaults, and custodians—but digital assets and real world assets (RWA) are changing how we safeguard and manage value. From decentralized wallets to blockchain-backed vaults, this transformation is enhancing security, accessibility, and control over personal and institutional wealth.

Why Wall Street Is Warming to the Tokenization of Assets

“Real-world asset tokenization” is the process of representing assets like bonds, stocks, art or even ownership shares in office buildings as digital tokens on a blockchain. Anyone who owns the token owns the asset. Ownership can be moved easily and almost instantly by simply moving it from one crypto wallet to another. It allows assets to be broken down into smaller parts, potentially widening the pool of ownership and easing the ability to trade.

The Future of Tokenization: Insights from the OECD

Tokenization might be one of the most exciting advancements in financial technology today. In October 2024, The Boston Consulting Group, Aptos Labs, and Invesco published a report on Tokenized Funds: The Third Revolution in Asset Management Decoded, arguing for tokenization's great potential. At that time, I wrote about fund tokenization and how, with effective regulation, sufficient oversight, technological reliability, and

Tokenized Everything: How Digital Assets and RWA Are Democratizing Ownership

Ownership used to be reserved for the wealthy elite—whether it was fine art, rare wines, or high-end real estate. Now, digital assets and real world assets (RWA) are changing the game by making ownership accessible, divisible, and transferable across global markets. This shift is democratizing access to wealth-building tools once limited to privileged circles.

Tokenization Is Playing a Central Role in the Shift to a Digital Economy

Any real-world asset (RWA) can be digitized and placed on the blockchain, from property deeds to stocks. The reasons to tokenize are many—it is a secure, fully transparent process where transactions settle instantly. Compared to their conventional counterparts, tokenized transactions can also carry significantly lower fees. Once an RWA is digitized, it can be fractionalized and sold to multiple parties

Tokenization beyond finance: Real-world assets will be crypto’s next engine

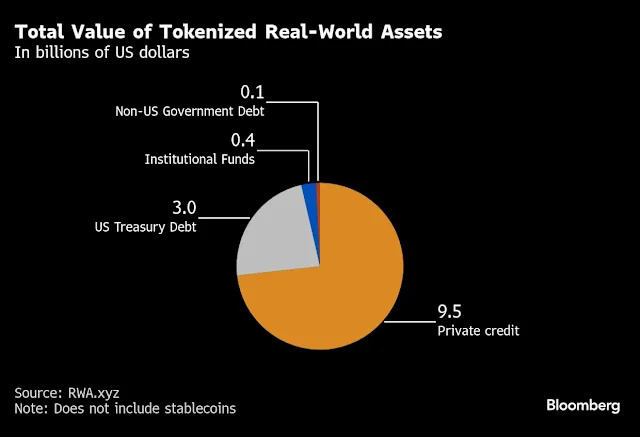

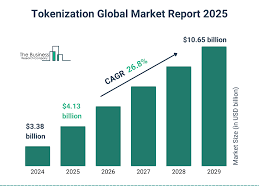

Real-world applications. As the name suggests, RWAs connect crypto to the real world; they embed physical value onto blockchains. Representing tangible assets—think real estate, infrastructure, commodities, or even records of deals—they ground crypto and connect it to the living, breathing economy. Tokenization will reach $2 trillion by 2030, driven by stocks, real estate, bonds, and gold. Backed by intrinsic value. RWAs are physical, not just digital or speculative, assets.

Why Real World Assets Are the Next Trillion-Dollar Frontier for Blockchain

While Bitcoin and Ethereum have dominated the crypto narrative, the next major wave of blockchain adoption is unfolding not in speculative tokens but in real world assets (RWA). From tokenized gold to digital real estate and decentralized lending protocols, RWAs are unlocking trillions in previously illiquid markets—ushering in a new era of financial innovation.

The Tokenization Rulebook: Compliance Strategies for the Digital Asset Revolution

The Evolution of Real-World Asset Tokenization Since Bitcoin’s creation in 2008, cryptocurrencies and traditional assets have largely existed in parallel. In our previous exploration of Real World Assets (RWAs) (Assessing the Benefits and Challenges of Tokenizing Real World Assets, February 7, 2024), we identified how the lack of reliable bridges between on-chain and off-chain ecosystems has constrained

Growing enthusiasm propels digital assets into the mainstream

The US election of 2024 may be viewed in hindsight as the major catalyst which propelled digital assets into the mainstream of the global financial system. After four years of skepticism, regulation by enforcement, and a host of scandals that set back the cause of decentralized finance, there is once again enthusiasm.\r\n\r\nIn no small part, crypto industry participants played a direct role in ushering in this new age.

From Pixels to Profit: How Digital Assets and RWA Are Merging Virtual and Physical Wealth

Startups require fast access to capital, clear investor alignment, and scalable growth strategies. Digital assets and real world assets (RWA) are accelerating startup innovation by enabling tokenized fundraising, transparent cap tables, and decentralized governance models that give founders greater control and flexibility.

Tokenization’s trillion dollar promise: Wall Street leaders make their case to the SEC

The tokenization opportunity most discussed currently in the traditional finance (TradFi) sector is tokenized collateral management, and the panel was no different. BlackRock’s Mitchnick described the current process of using money market funds for collateral without tokenization. “You first have to liquidate it (the money market fund), deliver cash, and then instruct reinvestment into a money market fund,

© 2026