IT IS YOUR MONEY

. The Rise of the Digital Landlord: How Digital Assets and RWA Are Redefining Real Estate Investment

Forget the traditional landlord with a keychain and repair calls—welcome to the era of the digital landlord , where real estate ownership is fractional, automated, and borderless. Digital assets and real world assets (RWA) are transforming real estate investment by enabling tokenized properties, self-executing leases, and global participation in one of the world’s most valuable asset classes.

Tokenized Properties: Own a Slice of Manhattan from Mumbai

Through blockchain platforms, investors can now purchase digital shares in commercial buildings, rental apartments, and vacation homes—without needing millions or dealing with local real estate agents. Companies like RealT and Propy allow users to earn rental income from tokenized real estate, paid automatically via smart contracts.

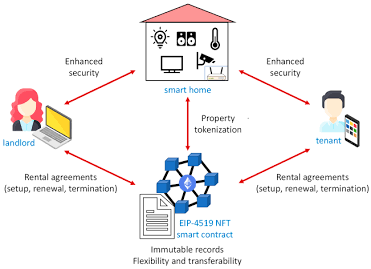

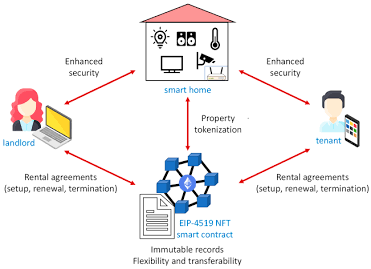

Smart Leases That Pay Themselves

Imagine a lease that collects rent, verifies tenant identity, and triggers maintenance requests—all without human intervention. Smart contracts powered by digital assets and RWA make this possible, reducing disputes, late payments, and administrative overhead for property owners.

Real-World Use Case: Labrys and Tokenized Office Spaces in Dubai

Labrys, a UAE-based fintech, has successfully tokenized office spaces in Dubai, offering investors transparent ownership records and automated dividend distributions. This model is attracting global capital into emerging real estate markets with previously limited access.

Liquidity in a Historically Illiquid Market

Real estate has long been considered a long-term, illiquid investment. But with digital assets and RWA, token holders can trade their shares on compliant exchanges, unlocking capital while retaining exposure to property appreciation and rental yields.

To explore how digital assets and RWA are turning everyday investors into digital landlords, visit DigitalAssets.Foundation for expert insights and a FREE consultation

More News

© 2026