IT IS YOUR MONEY

What Comes After ETFs? The Case for Tokenized Assets

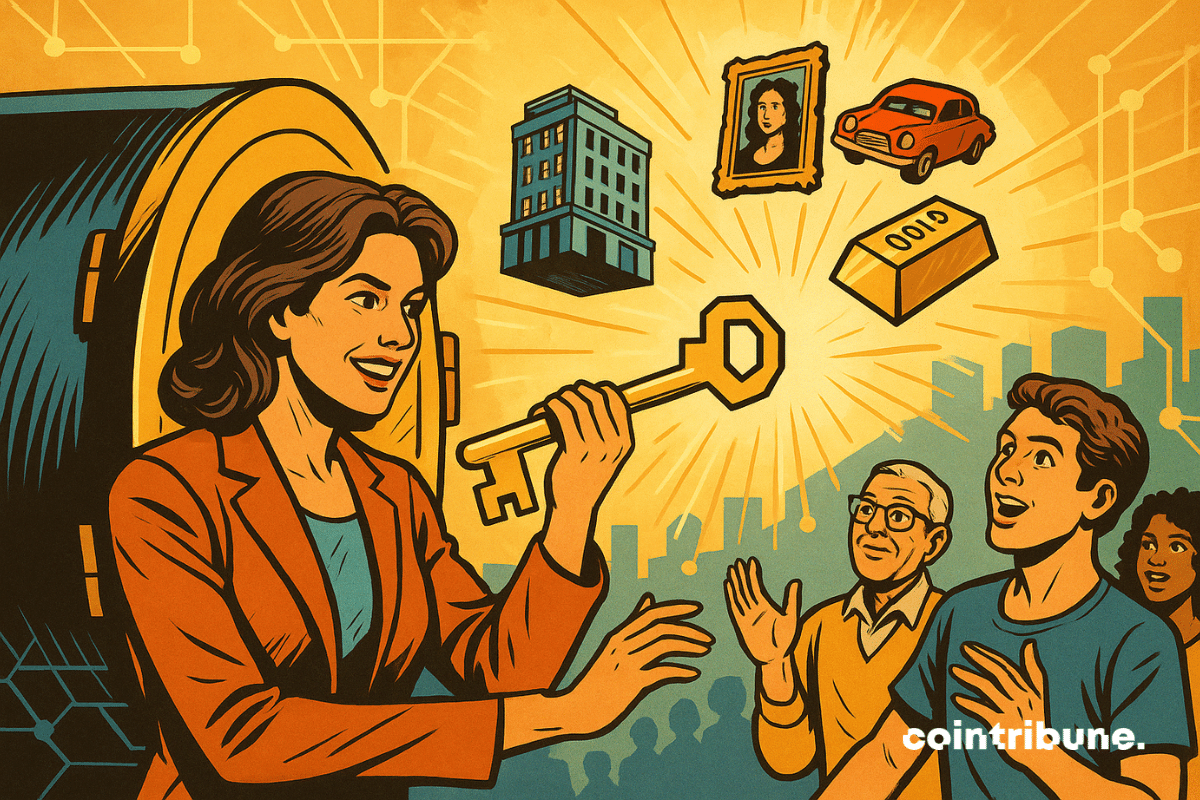

Tokenization emerged as a dominant theme at this year's Toronto-based Consensus conference, with panelists across the event emphasizing its growing role in reshaping global finance. Speakers noted that as regulatory clarity improves worldwide and as institutional adoption accelerates, tokenized assets are increasingly being viewed as an accessible on-ramp for retail investors. They pointed to tokenization’s potential to unlock efficiency, transparency and broader participation

How Digital Assets and RWA Are Reshaping Modern Finance

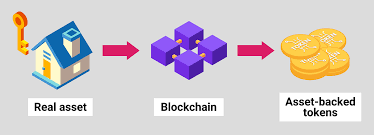

The convergence of digital assets and real world assets (RWA) is revolutionizing finance by merging traditional markets with blockchain technology. This integration allows tangible assets like real estate, commodities, and bonds to be tokenized and traded globally in a secure, transparent manner. Investors and institutions are increasingly recognizing the potential of this fusion to improve liquidity, reduce transaction costs, and democratize access to high-value investments.

Why Real-World Assets Backed by Digital Tokens Are the Future of Investing

Digital assets are increasingly being used to represent real-world assets (RWA), creating a new paradigm in investment strategies that combines innovation with tangible value.

Fidelity plans to tokenize Treasuries

Last week Fidelity Investments filed an SEC registration showing plans to launch a tokenized Treasury fund, the Fidelity Treasury Digital Fund. It follows the growing volume of tokenized Treasuries, with the total market capitalization now heading towards $5 billion, although there’s some double counting because some of the funds are backed by others on the list. BlackRock’s BUIDL leads the market with $1.4 billion in market capitalization

Blue Hat and Axis Capital Partner to Launch the World’s First Gold-Backed RWA Token

The Rise of RWA Tokenization in Gold Investments Reflecting a larger change in investor tastes toward digitalized commodities, the tokenization of gold has experienced explosive increase recently. By the end of 2024, market reports show that the value of real-world assets had been tokenized at around $13 billion. The popularity of Paxos Gold (PAXG), which expanded by over 20% in 2024 alone, underlines even more the rising acceptance of tokenized gold solutions.

How Digital Assets Are Bridging the Gap Between Finance and RWA

The integration of digital assets into real-world asset (RWA) frameworks is reshaping how we invest, trade, and manage physical value. From tokenized real estate to digitized commodities, this transformation is unlocking unprecedented liquidity and accessibility for global investors.

Bridging Real-World Assets and Crypto Markets: The Next Frontier of Tokenization

Traditional finance has long rested on rigid foundations—centralized control, heavy regulation, and high barriers to entry. Yet a quieter shift is underway. Tokenization, the process of bringing real-world assets onto blockchains, is gradually redrawing the map of global capital. This isn’t a tech fad. It’s a structural adjustment. Tokenization doesn’t replace existing systems; it refines them, making assets more transparent, more fluid, and far more accessible.

Unlocking Real World Assets (RWA) For Everyone

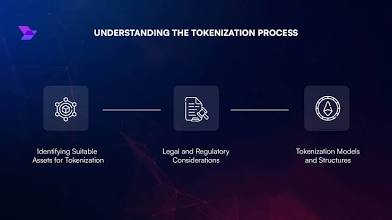

Turning a tangible asset into a tradable token isn’t a one-click operation. Real offers a comprehensive process designed to inspire trust at every stage—from physical reality to programmable finance. Asset Onboarding & Legal Wrapping Each asset enters the system through SPVs or trusts. This ensures that the token is backed by verified ownership or receivables. External audits uphold the operation’s integrity. On-Chain Minting as ERC-1400 Tokens The asset is then converted

Space Industry Looks to Digital Assets and RWA for the Final Frontier

Fueling Space Exploration with Tokenized Finance The space industry is looking to digital assets and Real World Assets (RWA) to fund exploration, research, and satellite development — unlocking new investment opportunities. From tokenized satellite ownership to decentralized space crowdfunding, blockchain is enabling broader participation in the commercial space race.

Asset tokenization: A beginner’s guide to converting RWAs into digital assets

Asset tokenization is about transforming real-world things like art, property or even stocks into digital tokens that you can buy, hold or trade on a blockchain. It is like giving your assets a digital upgrade. Thanks to blockchain technology and smart contracts, asset tokenization automates processes and makes them transparent. Asset tokenization has been steadily gaining momentum. According to Boston Consulting Group (BCG), the tokenized asset market could reach an astounding $16 trillion

Dubai launches first licensed tokenized real estate project in MENA region

D East and North Africa (MENA) region, previewing appetite for real-world tokenization in one of the world’s burgeoning crypto hubs. Partners in the project include the Dubai Land Department (DLD), the Central Bank of the United Arab Emirates, and the Dubai Future Foundation, according to an announcement from the Dubai government. The tokens will be tradeable on the newly launched “Prypco Mint” platform, with Zand Digital Bank appointed as the bank for the project’s pilot phase.

Government Bonds Get a Blockchain Upgrade with Digital Assets and RWA

Modernizing Public Finance Governments are modernizing bond issuance with digital assets and Real World Assets (RWA) — making public debt more transparent, liquid, and accessible. From digitized treasury bonds to tokenized municipal financing, blockchain is streamlining how governments raise capital and pay back investors.

Polymath CEO Comments on Impact of Tokenization on Digital Assets Ecosystem

Polymath CEO Comments on Impact of Tokenization on Digital Assets Ecosystem May 5, 2025 @ 10:30 am By Omar Faridi Listen to this article 0:00 / 8:39 1X BeyondWords Tokenization is no longer just an emerging digital technology trend. It’s becoming more widely adopted, and its ecosystem is expanding steadily. Many more companies, including Polymath, are now focused on the regulated side

Australia’s Crypto Regulation Framework Includes Digital Assets, Tokenization, and CBDCs

The Australian government under the leadership of Prime Minister Anthony Albanese has introduced a new crypto regulatory framework with the plan of integrating digital assets into the broader economy. A whitepaper from the Treasury outlines plans for real-world asset (RWA) tokenization and the development of central bank digital currencies (CBDCs) to modernize the country’s financial system. New regulations will apply to crypto custody services, exchanges, and other brokerage firms

Rewards Go Digital – Customer Loyalty Programs Reinvented with RWA

Rewards That Hold Real Value Customer loyalty programs are going digital — and the rewards now hold real-world value thanks to digital assets and Real World Assets (RWA). From airline miles to store points, tokenized loyalty programs offer greater flexibility, interoperability, and tangible benefits — changing how consumers engage with brands.

Tokenize.NYC by Wormhole and Securitize unites leaders to chart future of digital asset tokenization

Wormhole and Securitize successfully hosted the inaugural Tokenize.NYC conference on March 17, convening leaders in digital asset tokenization with institutions and asset managers. The exclusive event hosted key executives from Apollo, BlackRock, Skybridge Capital, VanEck, the Securities and Exchange Commission (SEC), and other influential organizations and crypto projects to discuss navigating the evolving landscape of tokenized assets.

On-Chain Real Assets (RWA): The Future of Traditional Finance and DeFi Is Here

The rise of real-world asset (RWA) tokenization is transforming the financial sector, boosting liquidity and accessibility. Franklin Templeton and BlackRock are leading the way with tokenized funds, as the market approaches $23.000 billion. The tokenization of real-world assets (RWA) is emerging as a transformative force in the global financial sector. This process allows traditional physical and financial assets such as real estate, bonds, or commodities

Smarter Insurance Underwriting with Digital Assets and RWA

Risk Assessment Gets a Digital Upgrade Insurance underwriting is being transformed by digital assets and Real World Assets (RWA) — making policies smarter, more personalized, and more responsive to real-time data. From parametric insurance to dynamic pricing models, blockchain and tokenized assets are reshaping how risk is assessed and priced.

Making Sense of Meme Coins, Digital Assets and Crypto’s Future

Valereum PLC (AQSE:VLRM) has launched its digital asset platform, VLRM Markets, marking its first step into regulated commercial activity in El Salvador. The platform is designed to turn real-world assets, from intellectual property to real estate and commodities, into digital tokens that can be traded, held, or used to raise capital. The move follows regulatory approval in El Salvador, where VLRM Markets is now licensed to issue and manage digital assets

DTCC Aims to Accelerate Adoption of Digital Assets

DTCC is naturally suited to take on the role of sponsoring a sandbox to help ensure interoperability because it is an industry utility owned and governed by its participants according to Chakar. She added: “In the US we are governed by multiple regulators, so sponsoring a sandbox has been a significant undertaking.” She highlighted the importance of DTCC’s experience in helping the industry to move to a shorter settlement cycle in the US

© 2026