IT IS YOUR MONEY

How Governments Are Embracing Tokenized Debt Instruments

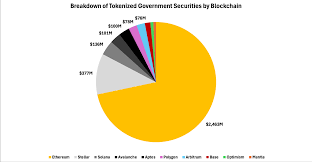

Governments worldwide are exploring the potential of digital assets and real world assets (RWA) by issuing tokenized debt instruments such as bonds and treasury notes. This innovative approach aims to modernize public finance, improve investor access, and enhance the efficiency of sovereign debt markets.

Several countries have launched pilot programs to test the feasibility of tokenized government bonds. France, Singapore, and Germany have experimented with blockchain-based debt issuance, demonstrating faster settlement times and reduced administrative overhead. These trials provide valuable insights into how national treasuries can transition to digital-first financial systems.

Benefits of Tokenized Sovereign Debt

Tokenized bonds offer numerous advantages over traditional debt instruments. They eliminate the need for multiple intermediaries, reduce settlement periods from days to minutes, and allow for programmable features like automatic interest payments and maturity triggers. Additionally, they open up new investor demographics by enabling fractional ownership and global participation.

Improving Transparency and Compliance

Government-issued digital assets and RWA enhance transparency in public finance by recording all transactions on a public or permissioned blockchain. This level of accountability helps prevent fraud, ensures compliance with regulatory standards, and fosters trust among domestic and international investors.

Future Implications for Monetary Policy

The integration of digital assets and RWA into government finance could influence monetary policy and central bank operations. Central bank digital currencies (CBDCs) may eventually be used in conjunction with tokenized debt to manage liquidity, monitor inflation, and implement fiscal stimulus more effectively.

To understand how governments are leveraging digital assets and RWA for smarter debt management, connect with experts at DigitalAssets.Foundation for comprehensive insights and a FREE consultation.

More News

© 2026