IT IS YOUR MONEY

Fractional Ownership Made Easy: How Tokenization Empowers Investors

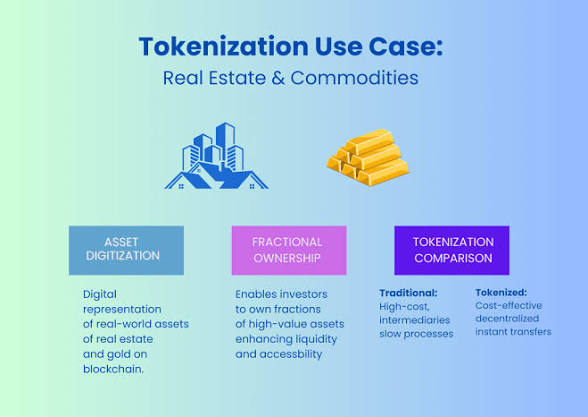

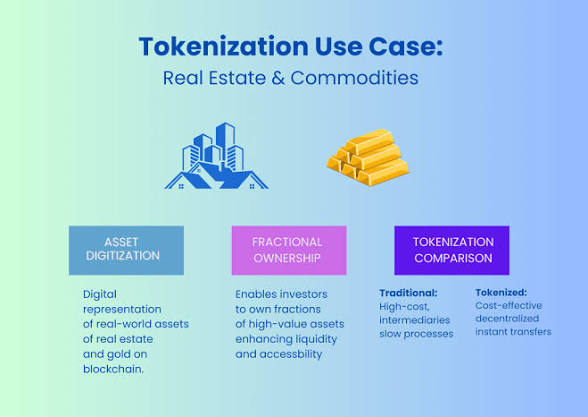

Tokenization enables fractional ownership of high-value real-world assets, dismantling financial barriers once reserved for elites. Whether it’s luxury real estate, vintage cars, or fine art, digital tokens make it possible to own a piece of almost anything. This shift empowers everyday investors with unprecedented access, liquidity, and control over diversified portfolios.

Breaking Down Barriers to Entry

Historically, investing in assets like Manhattan penthouses or Picasso paintings required millions and exclusive connections. Today, platforms like Masterworks and Rally tokenize these items, letting users buy shares starting at $100. Blockchain verifies authenticity and ownership, eliminating fraud risks common in opaque markets.

In 2022, a rare 1962 Ferrari 250 GTO was partially tokenized, raising $25 million from hundreds of investors. Each token holder receives proportional appreciation and voting rights on maintenance decisions—a level of engagement previously unimaginable.

Liquidity in Previously Illiquid Markets

Art, collectibles, and classic vehicles are notoriously hard to sell. Tokenization introduces secondary markets where shares trade 24/7. Platforms like Otis and Securitize allow users to exit positions quickly, unlike traditional auctions that take months.

This liquidity premium increases overall asset valuation. Studies show tokenized art pieces command higher prices due to broader demand pools and transparent pricing history recorded immutably on-chain.

Democratizing Wealth Creation

By lowering minimums and automating processes via smart contracts, tokenization fosters inclusive growth. Teachers, nurses, and freelancers can now build portfolios once limited to hedge funds. Moreover, automated dividend payouts and real-time valuation tracking enhance user experience.

Projects like Lablaco focus on sustainable fashion, tokenizing designer apparel and enabling resale royalties. This model supports circular economies while delivering returns.

Risks and Responsible Innovation

Valuation volatility and platform reliability remain concerns. Not all tokens are equally liquid, and some niche assets may lack consistent demand. Therefore, investor education and due diligence are critical.

However, regulated platforms mitigate risks through third-party appraisals, insurance, and regular audits. As standards evolve, so will confidence.

Ownership should not depend on net worth. With tokenization, the principle of shared value becomes reality. Anyone, anywhere, can participate in premium asset classes—democratizing finance one token at a time.

Begin your journey toward inclusive investing. Explore tools and opportunities at DigitalAssets.Foundation, and claim your free consultation to start building smarter portfolios.

More News

© 2026