IT IS YOUR MONEY

Charles Schwab leans into crypto, stablecoins. Tokenization

During Charles Schwab’s summer conference call update, CEO Rick Wurster confirmed plans to offer spot bitcoin and ether trading. He added that the company will also offer a stablecoin. However, Wurster expressed skepticism about tokenization, saying he has trouble seeing what problem it solves for public equities. On the crypto front, the company is one of the largest players in crypto ETPs with clients investing $25 billion

Tokenized Bonds: The New Era of Fixed Income

Tokenized bonds are redefining fixed income with faster settlements, 24/7 trading, and lower issuance costs. Governments and corporations are issuing digital bonds on blockchain to improve efficiency. Examples from France, Japan, and Germany show strong institutional adoption. This innovation brings transparency and accessibility to traditional debt markets.

building out technology to manage the tokenization of assets

One of the major financial discussion themes at 2024’s Annual Meeting was how physical and financial assets can be ‘tokenized’, meaning that a digital representation of the asset is created on the blockchain to allow them to be exchanged securely in real time. Now after years of investment, proof of concept and testing, the planets are aligning and tokenization of financial assets is finally happening at an institutional and governmental level.

Shariah-Compliant Blockchain for Tokenizing Real-World Assets

A Karachi-based team led by blockchain entrepreneur Abdul Rafay Gadit has unveiled ZIGChain, a base-level network designed from the ground up to satisfy Islamic finance principles while supporting the fast-growing market for tokenized real-world assets (RWAs). The mainnet beta, which went live earlier this week, positions itself as the first Layer 1 chain to embed native tools that help developers and institutions avoid interest-bearing structures

Blockchain Enables Transparent Commodity Trading

Blockchain is transforming commodity trading by enhancing transparency, reducing fraud, and streamlining supply chains. From gold to grain, digital ledgers track ownership and provenance in real time. Major players like Cargill and Mercuria are adopting blockchain to improve efficiency. This shift reduces settlement times and builds trust across global markets.

ZIGChain Debuts Shariah-Compliant Blockchain for Tokenizing Real-World Assets

Riding the RWA Surge Institutional appetite for putting property, commodities and traditional securities on-chain has expanded rapidly, with market estimates indicating a 260 percent jump to roughly US$50 billion in 2025. Analysts attribute the rise to financial firms seeking the improved liquidity, fractional ownership and auditability that blockchain ledgers can offer. Project backers contend that ZIGChain’s architecture—and its emphasis on compliance

Fiserv Unveils Stablecoin for its Network of Financial Institutions

More banks will soon have an avenue to capitalize on crypto, as Fiserv rolls out a digital assets platform and stablecoin that will be available to its customers. The stablecoin, FIUSD, along with the platform, will be accessible to banks and credit unions by the end of the year. This move is expected to dramatically increase the number of financial institutions that can offer crypto services. FIUSD will be built on infrastructure

How Tokenization Is Reshaping Private Equity

Private equity is becoming more accessible through tokenization, allowing fractional ownership and faster liquidity. Traditionally exclusive to institutions, these high-return investments are now open to a broader investor base. Blockchain enables transparent, compliant transactions with automated governance. Early adopters like SPiCE VC and AllianceBlock demonstrate how digital assets are modernizing private market investing.

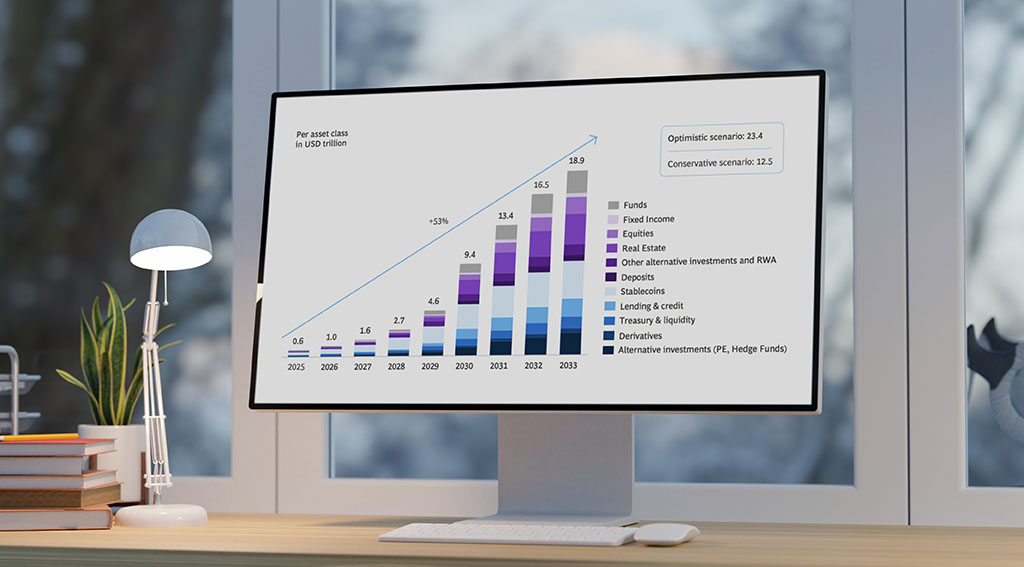

Tokenized Real-World Assets Market Expected to Reach US$18.9 Trillion by 2033

The market for tokenized real-world assets has grown significantly overt the past years and is projected to accelerate even further over the next decade. Between 2025 and 2033, the market is expected to achieve a compound annual growth rate (CAGR) of 53%, soaring from US$600 billion to US$18.9 trillion, according to a new report by digital asset infrastructure provider Ripple, and Boston Consulting Group (BCG).

Real-World Asset Tokenization Sets Kaanch Network Apart in the 2025 Crypto Race

Real-World Utility and Governance\r\nKaanch is unique in its approach to real-world asset tokenization, which allows safe and instant transactions of such assets as gold and real estate. Its community-based approach, which is backed by open governance and an easy-to-use staking dashboard, allows the holders of the $KNCH token to shape the future of the network, leading to long-term participation. The .knch domain system increases the usability of Web3,

Digital Assets: The Future of Global Investment

Digital assets are redefining global investment landscapes by offering secure, transparent, and accessible alternatives to traditional instruments. From cryptocurrencies to tokenized bonds, these assets leverage blockchain to enhance efficiency and inclusivity. Institutional adoption is accelerating, with central banks and asset managers integrating digital solutions. Real-world applications in trade finance and cross-border payments highlight their transformative potential.

Why Wall Street Veterans Are Turning to Tokenized Real-World Assets

Tokenizing Real-World Value Until recently, Web3 seemed like a speculative playground. Token values fluctuated drastically, and memecoins made headlines without providing substance. Large-scale enterprises are already anchoring tokens to actual assets like buildings, shipping containers, and even renewable energy credits, creating new opportunities for portfolio diversification.

State of Tokenization and Real-World Assets (RWAs) in 2025

Firepan, a leading voice in blockchain infrastructure and tokenization technology, is proud to announce the release of its mid-year report: The State of Tokenization and Real-World Assets (RWAs) - Mid-2025. The report delivers a comprehensive analysis of one of the most transformative trends in finance - the shift of traditionally illiquid assets onto blockchain rails through tokenization.

Bridging Real-World Assets and Crypto Markets: The Next Frontier of Tokenization

Tokenized Assets Meet Crypto Exchanges: A New Era of Market Access Across today’s blockchain landscape, the range of uses for tokenized assets continues to expand. Property tokens are now integrated into digital investment vehicles, commodity-backed instruments are being put to work in lending protocols, and even government bonds, once the realm of slow-moving institutions, are starting to appear in decentralized financial systems.

RWA Tokenization: Bridging Finance and Blockchain

Real World Asset (RWA) tokenization is revolutionizing finance by linking tangible assets like bonds, commodities, and real estate to blockchain technology. This bridge enhances liquidity, transparency, and accessibility across global markets. Institutions and investors are leveraging digital tokens to represent physical assets securely. Projects from Singapore to Switzerland demonstrate early success, setting the stage for widespread adoption in traditional finance.

Tokenization of Real-World Assets

Significant moves from the world’s largest custodians have signaled that the world’s assets are moving to blockchains. It’s something you’ll hear about today from Brownstone’s resident crypto expert, Ben Lilly… as well as why no one’s talking about it and why we should be paying attention. But first, don’t forget to go here to automatically sign up for our colleague Larry Benedict’s event this Wednesday at 11 a.m. ET. He’ll reveal his strategy for taking advantage of today’s market volati

Tokenizing entertainment: How real-world assets are reshaping the industry

From streaming royalties to concert tickets, the entertainment industry has long thrived on exclusivity. But today, blockchain is tearing down the velvet rope. Real-world asset (RWA) tokenization, once a niche concept in finance and real estate, is rapidly gaining ground in entertainment—giving artists new tools to monetize their work and letting fans go beyond just watching or listening. They can now invest, trade, and participate.

Tokenization Transforms Real Estate into Digital Assets

The real estate sector is undergoing a digital revolution through tokenization, enabling property ownership to be divided into secure, tradable digital tokens. This innovation increases liquidity, reduces entry barriers, and enhances transparency. By representing physical assets on blockchain networks, investors gain fractional access to high-value properties. Real-world pilots in Dubai and New York show promising results, signaling a shift in how we perceive and invest in real estate.

A look into the growing role of real-world assets and tokenization in web3 finance

Utility tokens presented a straightforward concept: digital assets that projects could utilize to access services, pay fees, or earn incentives. However, in practice, many tokens have struggled to demonstrate genuine utility. Some debuted before a functioning product was ready. Others functioned under unclear legal conditions, preventing consumers from understanding the potential uses and locations of the tokens.

BOM Network Unveils Solutions to Tokenize Real-World Assets

In recent years, the crypto market has undergone remarkable growth, but its volatility and limited real-world use cases have often raised concerns. Real-World Assets (RWA) are emerging as a pivotal trend that may fundamentally reshape the blockchain and crypto space by creating a more stable and tangible connection to traditional finance. The tokenization of RWAs

© 2026