IT IS YOUR MONEY

Digital Asset Custody: Safeguarding Value

Digital asset custody is critical for securing tokenized real-world assets, cryptocurrencies, and security tokens. Institutional-grade solutions combine cold storage, multi-sig wallets, and insurance to protect holdings. Firms like Fireblocks, Coinbase Custody, and Sygnum serve investors, funds, and enterprises. As digital assets grow, robust custody is the foundation of trust and compliance in the new financial ecosystem.

The Growing Need for Secure Digital Custody

As real-world assets move on-chain, safeguarding digital ownership becomes paramount. Unlike traditional assets held in banks or vaults, digital assets exist as cryptographic keys—making them vulnerable to hacking, loss, or theft if not properly managed.

Digital asset custody refers to the secure storage, management, and transfer of private keys that control blockchain-based assets. It is essential for institutional investors, funds, and enterprises adopting tokenization.

A single compromised key can result in irreversible loss—highlighted by incidents like the $600 million Poly Network hack. Robust custody solutions prevent such risks through layered security and compliance protocols.

Types of Custody Solutions

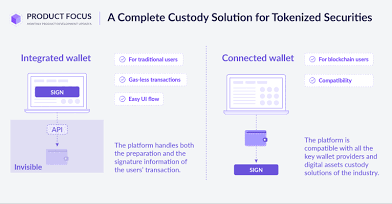

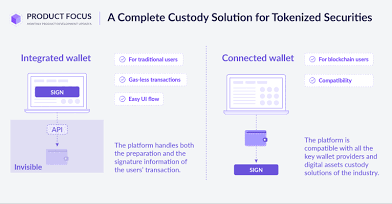

There are three primary models:

Hot Wallets: Connected to the internet; suitable for frequent transactions but higher risk.

Cold Wallets: Offline storage (e.g., hardware devices); highly secure for long-term holdings.

Multi-Party Computation (MPC) & Threshold Signatures: Distribute key fragments across parties, eliminating single points of failure.

Institutional platforms like Fireblocks and Copper use MPC to enable secure transfers without exposing full private keys. Coinbase Custody and Anchorage Digital (now part of Visa) offer insured cold storage with audit trails and regulatory compliance.

Insurance and Regulatory Compliance

Top custody providers partner with insurers like Lloyd’s and Chubb to offer coverage up to $500 million per client. Policies cover theft, cyberattacks, and employee fraud.

Regulatory compliance is equally important. Licensed custodians operate under frameworks such as:

NYDFS BitLicense (U.S.)

VASP registration (EU under MiCA)

VFA license (Switzerland)

This ensures adherence to AML, KYC, and reporting requirements, making custody a cornerstone of regulated digital finance.

Real-World Applications and Institutional Trust

BlackRock uses Fireblocks to custody digital assets for its BUIDL Fund. JPMorgan integrates blockchain custody into its Onyx network for institutional clients.

Tokenized real estate platforms like Lofty AI store property ownership tokens in insured cold wallets, ensuring investor protection.

Even central banks exploring CBDCs rely on secure custody architectures to manage wholesale digital currency reserves.

The Future of Trusted Asset Management

As digital assets become mainstream, custody will evolve into a standardized, interoperable layer of financial infrastructure—much like clearinghouses today.

Innovation in decentralized custody, biometric authentication, and AI-driven threat detection will further enhance security.

Robust custody is not just about protection—it’s about enabling trust, compliance, and scalability in the digital asset economy.

To ensure your digital assets are securely managed with institutional-grade protection, visit DigitalAssets.Foundation and speak with experts. FREE consultation

More News

© 2026