IT IS YOUR MONEY

Real Estate Investment Trusts Go On-Chain

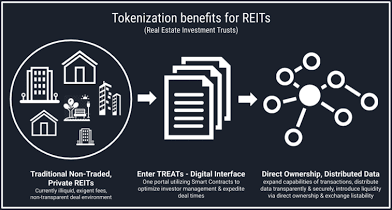

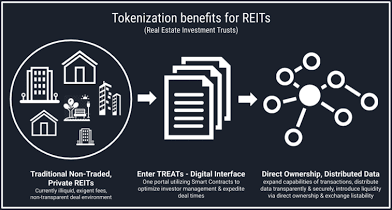

Real Estate Investment Trusts (REITs) are moving on-chain, combining the income stability of traditional REITs with the efficiency of blockchain. Tokenized REITs offer fractional ownership, 24/7 trading, and automated dividend distribution. Firms in the U.S., Europe, and Asia are launching digital versions of commercial and residential portfolios. This shift enhances liquidity and global investor access.

The Evolution of REITs in the Digital Age

Real Estate Investment Trusts (REITs) have long provided investors with access to income-generating properties—office buildings, malls, apartments—without direct ownership. However, traditional REITs operate on centralized exchanges with limited trading hours, high fees, and minimum investment thresholds.

Tokenized REITs preserve the core benefits—dividend yields, diversification, regulatory compliance—while leveraging blockchain for faster settlement, lower costs, and fractional shares. Each token represents a share in a legally structured REIT entity, backed by real estate assets.

This hybrid model bridges Wall Street and Web3, offering the best of both worlds.

How On-Chain REITs Work

A traditional REIT structure is maintained: a legal entity owns income-producing properties and distributes 90%+ of taxable income to shareholders. The innovation lies in digitizing shares as security tokens on a blockchain.

Investors purchase tokens using fiat or stablecoins via regulated platforms. Smart contracts automate:

Monthly or quarterly dividend payouts in USDC or EURS

Investor onboarding with KYC/AML checks

Voting rights for major decisions (e.g., asset sales)

Secondary market trading on digital securities exchanges

For example, a tokenized REIT holding 10 office buildings in Berlin can issue 1 million tokens at €100 each. Investors earn net rental yields of 5–7%, paid automatically.

Global Launches and Institutional Adoption

In 2023, Bordeaux Index, a UK-based property firm, launched a tokenized REIT for luxury London apartments, attracting over €50 million from global investors. Tokens trade on the MEXC Global digital exchange under regulatory oversight.

In Switzerland, Axion Real Estate tokenized a CHF 100 million portfolio of commercial properties, offering accredited investors yields of 4.8% with monthly liquidity—unheard of in traditional REITs.

In the U.S., Securitize and RealT are working with real estate firms to launch compliant tokenized REITs focused on multifamily housing and industrial warehouses, targeting both retail and institutional capital.

Advantages Over Traditional REITs

Tokenized REITs offer 24/7 trading, unlike stock exchange-listed REITs limited to business hours. Settlement occurs in minutes, not T+2.

Fractional ownership allows investors to buy as little as 0.01% of a REIT share, lowering entry barriers.

Transparency improves with on-chain records of occupancy rates, lease expirations, and maintenance costs—visible to all token holders.

Additionally, global access enables cross-border investment without currency conversion delays.

Regulatory and Market Challenges

Compliance is critical. Tokenized REITs must adhere to securities laws in each jurisdiction. Platforms use geo-blocking and investor verification to ensure adherence to rules like Reg D (U.S.) or MiCA (EU).

Liquidity depends on secondary market depth. While growing, digital securities exchanges are still less liquid than major stock markets.

As adoption increases and regulatory clarity solidifies, tokenized REITs are poised to become a mainstream investment vehicle.

The future of real estate investing is digital, liquid, and inclusive. By merging the income stability of REITs with blockchain efficiency, this innovation is redefining passive income for a global audience.

To learn how tokenized REITs can deliver steady yields with enhanced accessibility, visit DigitalAssets.Foundation and consult an specialists FREE.

More News

© 2026