IT IS YOUR MONEY

Tokenized Loans: DeFi Meets Traditional Credit

Tokenized loans are bridging decentralized finance and traditional credit by enabling on-chain lending backed by real-world assets. From business loans to mortgages, digital tokens represent debt obligations with automated repayments. Platforms like Maple Finance and Goldfinch are proving this model works at scale. This fusion enhances liquidity, transparency, and access to capital.

How Tokenized Loans Work

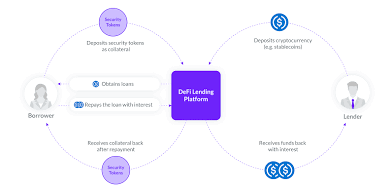

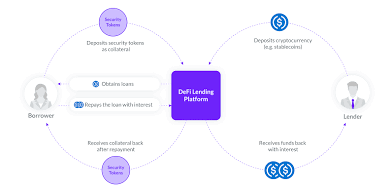

Tokenized loans represent traditional debt instruments—such as corporate credit lines, SME financing, or consumer loans—as digital assets on a blockchain. The loan agreement is encoded into a smart contract, and repayment streams are tokenized, allowing investors to purchase fractional stakes in the debt.

For example, a $1 million business loan can be split into 1,000 tokens, each representing $1,000 of principal plus interest. Investors earn yield as the borrower repays, with payments distributed automatically via the blockchain.

This model reduces reliance on banks as intermediaries while maintaining credit risk assessment through off-chain due diligence.

Leading Platforms and Use Cases

Maple Finance has emerged as a leader in institutional-grade tokenized lending. It enables creditworthy firms—such as fintechs and crypto exchanges—to borrow from decentralized liquidity pools. As of 2024, Maple has facilitated over $1.5 billion in loans, with default rates below 2%, thanks to rigorous underwriting by "pool delegates."

Goldfinch operates a similar model but focuses on emerging markets. It has funded microfinance institutions in Nigeria and small businesses in Vietnam, using on-chain tokens to represent off-balance-sheet debt. Repayments are verified through third-party data feeds and triggered automatically.

In real estate, platforms like Centrifuge tokenize mortgage notes, allowing DeFi investors to earn yield from property-backed loans in Europe and the U.S.

Benefits: Efficiency, Transparency, and Inclusion

Tokenized loans offer faster settlement, 24/7 availability, and reduced administrative costs. Borrowers gain access to global capital pools, while lenders benefit from diversified, income-generating assets.

Transparency is enhanced—investors can view loan terms, borrower ratings, and repayment history on-chain. This reduces information asymmetry and builds trust.

Additionally, the model expands financial inclusion. SMEs in underserved regions can access funding without traditional banking relationships, while global investors gain exposure to high-yield credit markets.

Regulatory and Risk Considerations

Credit risk remains central. While smart contracts automate payments, they cannot enforce repayment if a borrower defaults. Legal recourse must be established in the underlying jurisdiction.

Regulators are monitoring closely. The U.S. Office of the Comptroller of the Currency has issued guidance on crypto-asset lending, while the EU is incorporating tokenized credit into its Digital Finance Strategy.

As compliance frameworks mature, tokenized loans are poised to become a mainstream financial instrument.

The convergence of DeFi efficiency and real-world credit is reshaping lending. It’s creating a more open, transparent, and globally connected financial system where capital flows to where it’s needed most.

To learn how tokenized loans can diversify your fixed-income portfolio or expand your business financing options, visit DigitalAssets.Foundation and consult with specialists for a FREE consultation.

More News

© 2026