IT IS YOUR MONEY

Gig Workers Rejoice – Fast, Borderless Payments via Digital Assets

Faster Payouts for the Global Workforce

Digital assets are transforming how gig workers get paid — offering instant, secure, and borderless transactions.

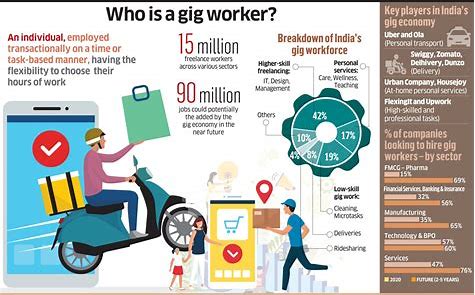

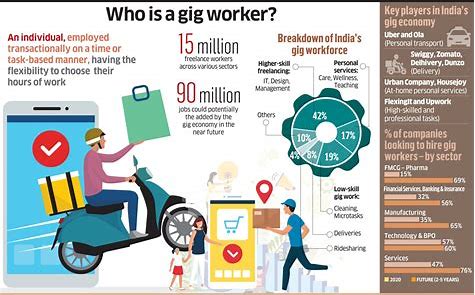

The rise of remote work has created a global gig economy, where freelancers, drivers, and content creators serve clients across continents. Yet traditional payment methods often delay earnings by days or even weeks. Digital assets solve this problem by enabling real-time, frictionless payouts — no matter where you are.

Reduced Transaction Costs

Traditional wire transfers and credit card processors charge hefty fees — sometimes up to 10% of earnings.

With digital assets, transaction costs are minimal, allowing gig workers to keep more of what they earn. This is especially impactful for those earning small amounts per task.

Micropayments Enable New Business Models

Digital assets make micropayments feasible — opening up new revenue streams for creators and service providers.

For instance, content creators on platforms like Audius or LBRY receive direct payments from fans for every view or download, something not viable with traditional payment systems.

Greater Control Over Earnings

With digital asset wallets, gig workers maintain full control over their funds — without relying on third-party platforms to release payments.

Apps like Trust Wallet and MetaMask give users ownership of their earnings and the ability to transfer them instantly.

Conclusion: A Better Way to Get Paid

Digital assets empower gig workers with faster, cheaper, and more flexible payment options. As the global workforce becomes increasingly decentralized, these tools will be essential for fair compensation.

Ready to get paid faster. Check what the DigitalAssets.Foundation recommendations are.

More News

© 2026