IT IS YOUR MONEY

Tokenizing: A Game Changer for Philanthropy and Social Impact Bonds

Philanthropy and social impact investing are increasingly focused on measurable outcomes and efficient capital deployment. Digital assets and real world assets (RWA) are transforming this space by enabling transparent giving, performance-linked funding, and decentralized governance models that align donor intent with real-world impact.

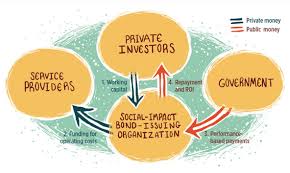

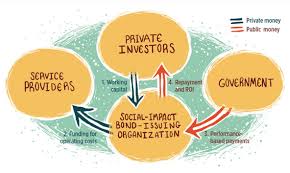

Tokenized Social Impact Bonds for Measurable Outcomes

Social impact bonds (SIBs) can be tokenized to allow fractional investment from a global pool of donors and investors. Returns are tied to predefined social outcomes—such as reduced recidivism rates or improved education metrics—ensuring that capital is deployed effectively.

Real-Time Impact Reporting and Fund Allocation

Blockchain-based dashboards provide real-time updates on how donations and investments are being used, including beneficiary outcomes, project milestones, and financial audits. This level of transparency builds trust and encourages sustained philanthropy.

Real-World Example: UNICEF’s Cryptocurrency Fund for Innovation Grants

UNICEF’s cryptocurrency fund accepts donations in digital assets and allocates them to startups developing solutions for children’s health, education, and safety. Digital assets and RWA enhance fund management, reporting, and impact tracking across global initiatives.

Decentralized Autonomous Organizations (DAOs) for Community-Led Giving

DAOs enable communities to collectively decide how to allocate charitable funds. Donors can participate in governance, vote on initiatives, and track progress—all facilitated by blockchain-based transparency and accountability.

To explore how digital assets and RWA are transforming philanthropy and social impact investment, visit DigitalAssets.Foundation for expert guidance and a FREE consultation.

More News

© 2026