IT IS YOUR MONEY

Decentralized Finance Explained – And Why It’s Built on Digital Assets and RWA

Finance Without Middlemen

Decentralized Finance (DeFi) is redefining how we borrow, lend, and invest — all thanks to digital assets and Real World Assets (RWA).

Traditional finance relies on banks, brokers, and custodians.

DeFi replaces these intermediaries with smart contracts and blockchain, offering permissionless access to financial services for anyone with an internet connection

How DeFi Works

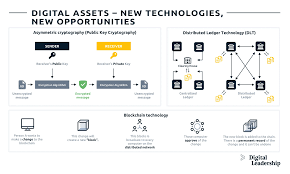

DeFi platforms run on blockchains like Ethereum, allowing users to interact directly with financial protocols.

Instead of depositing money into a bank, users provide liquidity to decentralized pools and earn rewards in return.

Smart contracts automate lending, borrowing, trading, and yield farming — reducing costs and increasing transparency.

Key Components of DeFi

Popular DeFi applications include:

Lending/Borrowing Protocols (Aave, Compound)

Decentralized Exchanges (Uniswap, SushiSwap)

Yield Farming Tools (Yearn.Finance)

Stablecoins (DAI, USDC backed by RWA)

Each plays a role in building an open, permissionless financial system anchored in real-world value.

Benefits of DeFi

DeFi offers higher yields, lower fees, and greater transparency compared to traditional finance.

Users can access services 24/7, without waiting for bank approval or geographic restrictions.

More importantly, DeFi is increasingly integrating RWA-backed assets — ensuring that returns are tied to real economic activity rather than speculation.

Conclusion: The Future of Finance Is Decentralized

DeFi is built on digital assets and RWA — and together, they’re paving the way for a more open, transparent, and inclusive financial system.

Ready to explore DeFi?

Visit DigitalAssets.Foundation to learn how you can participate in this financial revolution — and schedule your FREE consultation today.

More News

© 2026